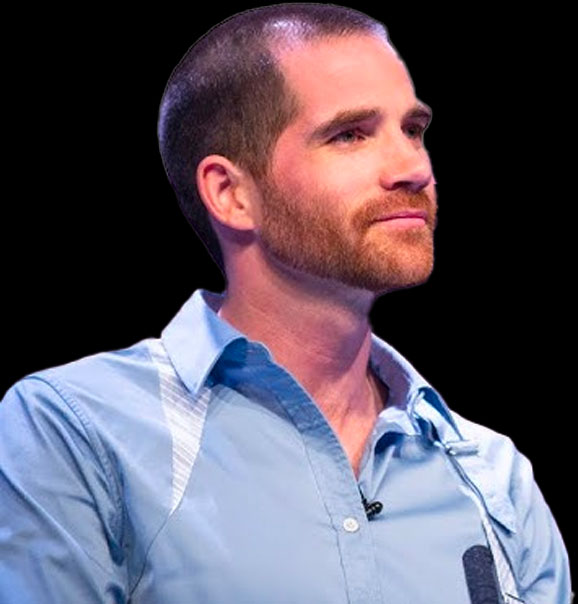

“Step into The Disruptive Entrepreneur™’s world, where norms crumble and Rob Moore reigns as an audacious icon. A business maverick, author extraordinaire, and thunderous speaker. He’s a podcast czar, with the #Disruptors show amassing 100 million yearly devotees.

Rob Moore is not only an innovator; he is a financial expert in generating £200 million through Progressive Property. A property maestro, with 340 units under his command. But his mission pulses deeper. Rob.team empowers wealth alchemy.

Rob has also artfully penned 19 best-selling books on Money & Life Leverage, crafting a trusted path to financial mastery and life abundance. His vision: global financial literacy. His mission: ignite entrepreneur empires. The Rob Moore Foundation lights paths for underprivileged youth.

“If you don’t risk anything, you risk everything,” Rob’s mantra. From £50k debt at 25 to multimillionaire at 30, he co-founded the Progressive Group, birthing legends like Progressive Successes, and Entrepreneurs Business Academy. Business of the Year 2016, their legacy spans borders.

“Step into his saga, redefine limits in 168 words, About me“